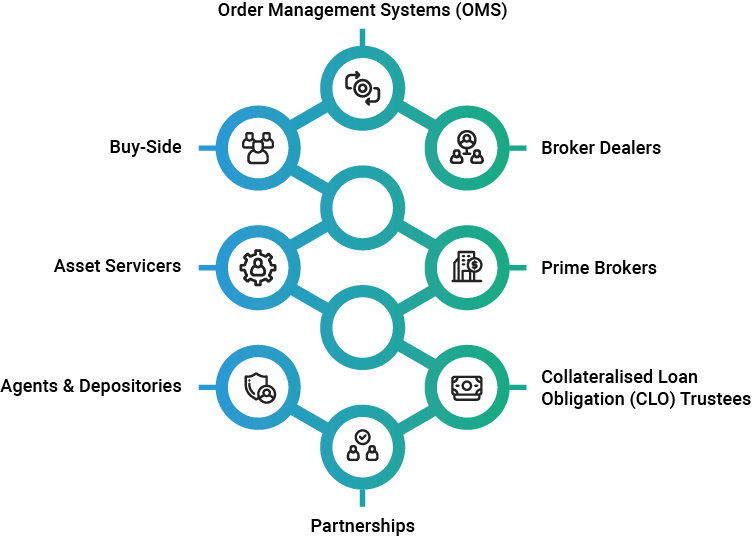

Synergy is an extensive network with over 250 live members, connecting the entire ecosystem — Buy-Side, Sell-Side, Asset Servicers,and OMS platforms.

Synergy accelerates time to market with seamless integration. The Network encompasses a broad spectrum of asset classes, including Securities, Derivatives and Alternatives. It enables data transformation between participants, facilitating collaboration and interoperability across the network. Synergy is built on modern cloud-based architecture with microservices, using an API-first approach for scalability and flexibility.

By leveraging AI-driven insights exceptions can be resolved faster, boosting operational efficiency and reducing manual intervention.

Synergy’s Product Suite

Synergy’s 3 core intelligence capabilities include:

Synergy Status

Provides one combined status across Buy-side, Sell-Side, Custodians & Agents, giving real-time visibility into transaction status, enabling users to quickly identify progress, exceptions, and resolutions. Synergy Status ensures transparency across the transaction lifecycle, improving operational efficiency.

Synergy Insights

Delivers AI-driven analysis and contextual insights on transactions, helping users uncover patterns, predict outcomes, and make data-informed decisions. Synergy Insights empowers proactive management and better decision-making.

Synergy Actions

Enables users to take direct action on transactions, such as assigning a task or amending transactions, streamlining workflows and reducing resolution time by eliminating emails. Synergy Actions simplifies operational tasks, enhancing control and agility.

Request a meeting

Complete the form to request a meeting with our team and find out how AccessFintech’s Synergy Network can support your organisation.